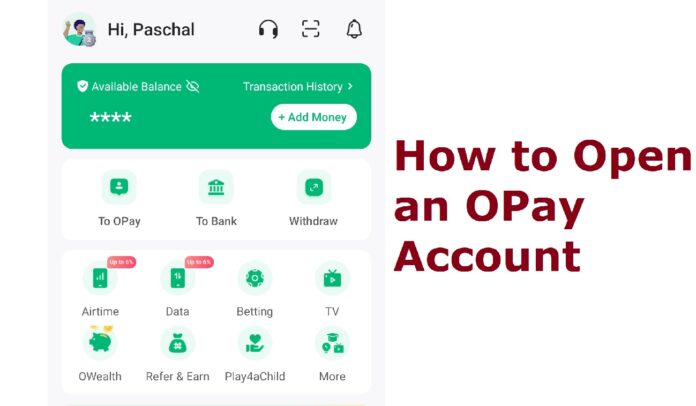

OPay is a leading mobile banking and payment platform that allows you to make fast and secure financial transactions with just a few clicks. Whether you want to save money at attractive interest rate or send money to a friend, pay bills, or shop online, OPay has got you covered. In this article, we will guide you through how to open an OPay account, step by step.

All you need to open an OPay account is a smartphone and an internet connection. We will show you how to download and install the app, create your account, and verify your identity. It is a straightforward process that will have you up and running in no time.

Use this my link to Open an OPay account and get up to ₦1,200 in reward as welcome bonus.

Benefits of Opening an OPay Account

Opening an OPay account comes with a number of benefits that will simplify your financial transactions and give ease of mind. Here are some of the advantages you can enjoy:

- Convenience: With an OPay account, you can say goodbye to the hassle of carrying cash or searching for ATMs. All your transactions can be done with just a few taps on your smartphone. You can even use USSD codes to conduct your transactions on OPay using a basic phone if you do not have a smartphone. OPay also offers an ATM card for those times when paying with cash is inevitable.

- Low Transfer Rate: OPay offers three free transfers daily. This means that you only pay for transfer if you do four or more transfers in a day. Even when you exhaust your three free transfers, you only pay ₦10 for each subsequent transfer.

- Attractive Interest on Savings: OPay has a savings solution called OWealth that offers you up to 15% interest rate on your balance. This is way more than what you get from traditional banks. More so, you can spend your money at anytime without bottlenecks.

- Enjoy Cashback: The payment solution offers you cashback on your purchases on the platform. For example, you get some cashback when you buy airtime or data on the platform.

- Security: OPay ensures the security of your financial information and transactions through advanced encryption technology. You can have peace of mind knowing that your sensitive data is protected. Your transactions are secured with PIN and even fingerprint authentication.

- Speed: Traditional banking methods can be time-consuming, but OPay allows you to complete transactions within seconds. Whether you are sending money or paying bills, the payment solution’s fast processing times will save you valuable time.

- Versatility: OPay offers a wide range of services, including attractive savings solutions, money transfers, bill payments, and online shopping. You can use a single app for all your financial needs, eliminating the need for multiple platforms.

Requirements for Opening an OPay Account

Before you start opening an OPay account, make sure you have the following:

- Smartphone: OPay is a mobile-based platform, so you will need a smartphone (iPhone or Android phone) to download and use the OPay app on the App Store or Google Play Store.

- Internet connection: To access and use the app, you need an internet connection. Wi-Fi or mobile data will work just fine.

- Personal Details: You will be required to provide details like your name, email, phone number, etc.

As you can see you do not require a lot to open and OPay account making it very accessible to consumers of all kinds.

When you open an OPay account with these minimum requirements, you will get a Tier 1 account that enable you do up to ₦50,000 worth of transactions daily and a maximum account balance of ₦300,000.

To increase your OPay limits, you need to upgrade to a Tier 2 account by submitting your Bank Identification Number (BVN) and your residential address. Upgrading to a Tier 2 account increases your daily transaction limit to ₦200,000 and your maximum account balance to ₦500,000.

You can also upgrade to a Tier 3 account for limitless banking. To upgrade to Tier 3, you will need to verify your residential address with a utility bill, waste bill, etc, a means of identification like National Identification Number (NIN), International Passport, Voter’s Card, Driver’s License, etc, and a passport photograph.

Upgrading to a Tier 3 account increases your daily transaction limit to ₦5,000,000. At Tier 3, maximum account balance is unlimited.

You may also be interested on the Best Quick Loan Apps in Nigeria.

How to Open an OPay Account, Step-by-Step Guide

Now that you know the necessary requirements, let us dive into the step-by-step process of opening an Opay account:

- Download the OPay app: Go to Google Play Store for Android users or Apple App Store for iOS users and search for “OPay.” Download and install the app on your device. Use this link to download and get up to ₦1200 bonus.

- Launch the App: Once the app is installed, locate the app icon on your home screen and tap on it to launch the app.

- Create your account: On the app’s home screen, you will see an option to “Sign Up” or “Register.” Tap on it to begin the account creation process.

- Enter your Personal Information: Provide the required details, including your full name, phone number, and email address. Make sure the information is accurate and up to date.

- Verify your Phone Number: To verify your phone number, you will be sent a six digit code.

- Set up a PIN: You will be prompted to set up a PIN for your account. This PIN will be used to authenticate your transactions and ensure the security of your account.

- Enter your BVN: Enter your BVN if you have one. If you do not have you can skip this requirement for now. Note that skipping the submission of BVN will limit your daily transaction limit of ₦50,000 and a maximum account balance of ₦300,000. Whenever you add your BVN, your transaction limit will be increased.

- Complete the registration: Once you have set up your PIN, you will receive a confirmation message indicating that your account registration is complete. Congratulations! You are now ready to start using OPay for your financial transactions.

How to Open an OPay Account without BVN

You do not need BVN to open an OPay account. Your name, email, and phone number is all you need. This makes it very accessible to everyone. Both the banked and the unbanked can easily get access to banking services on the platform.

During the registration process, the app will request for your BVN, but will also give you the option to skip adding your BVN. If you do not have BVN, you can skip the process.

The only catch is that your account will be limited to a daily transaction limit of ₦50,000 and a maximum account balance of ₦300,000. You will have to submit your BVN if you want your account limit to be increased.

How to Open an OPay Account with USSD Code

Although you can do other transactions like send money to other accounts or buy airtime via USSD, you cannot open an OPay account using USSD. When you dial *955#, you will be given an option to register but when you select that option, you will only be provided instruction to download the app at the store.

You will need a smartphone to open an OPay account. However, once you have downloaded, installed the app and opened an account, you can conduct your transactions via USSD using any mobile phone including a basic phone.

How to use OPay with USSD Code or a Basic Phone

While you need a smartphone to open an OPay account, because you need to download the app, you do not need a smartphone to complete your financial transactions. Once your account is created, you can use the app or USSD code to complete your transactions. This means that a basic phone without internet access can be used for your transactions.

Just dial *955# on your phone right now to see all the supported transaction you can do with USSD.

How to Fund your OPay Account

Now that your OPay account is up and running, let’s explore how you can fund it for seamless transactions.

There are multiple options for funding your OPay account. If you already have an account with another bank, you can simply transfer funds from your existing bank account to your OPay wallet.

Another way to fund your OPay account is to visit an OPay merchant near you with your cash deposit and they will fund your wallet. On the app, you tap on the Add Money button and select the Cash Deposit option. Tap on the Find nearby OPay merchants and the app will display merchants near you that can fund your account.

Also see MoMo Bill Payment: What it is and why to use it

Using your OPay account for Transactions

Now that your OPay account is funded, you can start using it for various transactions. Here are some financial transactions supported by the app:

- Sending Money: Send money to friends, family, or business associates with ease. Simply open the app, tap on the To Bank icon, enter the recipient’s details, like account number and bank to confirm the transfer. To send to other OPay users tap on the To OPay icon instead.

- Paying Bills: You can conveniently pay your utility bills for Electricity, Waste Management, Pay TV and more from the comfort of your home. You can also pay for data, government services and more. To pay bills, open the app, tap on the “More” icon, to see the full list of bills payment supported on the app. Select the bill you want to pay, enter the required details, and complete the payment.

- Online Shopping: You can shop online with the funds in your wallet. Just apply for a physical or virtual card to start shopping online. The card can be used to shop at over 40,000 online merchants including Jumia, Konga, Netfix, Uber, etc

- QR Code Payments: The app supports QR code payments, allowing you to make transactions at participating merchants by scanning their QR codes. Simply open the app, tap on the “Scan QR Code” icon, scan the merchant’s QR code, enter the payment amount, and confirm the transaction.

- Save Money: OPay offers an attractive interest rate for your savings via OWealth. OWealth currently offers 15% per annum for the first ₦100,000 and 5% per annum for the remainder of your balance. There is also a Fixed plan that offers interest of between 15% and 18% per annum for the first ₦300,000 depending on the duration you want to fix the deposit, ranging from 7 to 1000 days. On the fixed plan, you get an interest rate of between 6% and 9% on your remaining balance depending on the duration of the deposit.

How to Save and Invest with OPay

Saving money on OPay is very easy just move the amount you want to save from your main wallet to your OWealth wallet. You can also choose the auto save option, which will automatically move all your balance to OWealth anytime you fund your wallet.

How to Withdraw from OWealth

Since, your balance is combined with your OWealth funds, you can easily withdraw your funds at anytime. To withdraw from OWealth, all you have to do is transfer the amount you want to your own bank account.

Just tap on the To Bank icon and enter the account number you want to withdraw the funds to and your bank account will be credited in seconds.

Another way to withdraw from OWealth is via your ATM card or POS agent. Just visit any ATM machine or POS agent to withdraw cash.

OPay Account Security Tips

While OPay ensures the security of your transactions, it is always good to take additional precautions to protect your account. Here are some security tips to keep in mind:

- Use a strong PIN: Choose a PIN that is not easily guessable and avoid sharing it with anyone. Regularly update your PIN to enhance security.

- Beware of phishing attempts: Be cautious of any suspicious emails, messages, or calls asking for your account information. OPay will never request sensitive information outside of the app.

- Keep your app updated: Regularly update the app to ensure you have the latest security patches and features.

- Monitor your transactions: Regularly review your transaction history within the app to identify any unauthorized activities. If you notice any discrepancies, report them immediately.

OPay Customer Support

If you encounter any issues or have questions regarding your account, the OPay customer support will assist you. Here is how you can reach out to them:

- In-app support: Open the app, tap on the “Me” icon on the bottom of the screen, and browse through it and tap on Customer Service Center. There you will see a self service option to help yourself. If you need to be served by a customer support personnel, tap on the Live Chat option. To report an issue tap on the Report an issue option. If you can’t find the answer to your question, you can submit a support request through the app.

- Office Address: If you prefer your issue be handled at a physical location, you can check if OPay has an office in your city or state. To see if there is an office in your location, open the app tap on the “Me” on the bottom of the screen, and browse through it and tap on Customer Service Center. Then tap on the Office address to see a list of office locations.

- Social Media: OPay maintains a presence on various social media platforms. You can reach out to them through their official social media accounts and seek assistance.

Conclusion

Congratulations on successfully opening your OPay account. You are now equipped with the knowledge and tools to make fast and secure financial transactions. Whether you need to send money, pay bills, shop online, or save money, OPay has made it easier than ever.

Remember to keep your account secure by following the recommended security tips. If you ever face any issues, don’t hesitate to reach out to their customer support team for assistance.