2026 is the year more Nigerians will start paying tax (especially income taxes) as the government, via the NRS (Nigeria Revenue Service) and the JRB (Joint Revenue Board), commences full implementation of the new tax laws from January 1, 2026. One of the first steps to being tax-compliant in Nigeria is obtaining a tax ID. In this article, I will provide a step-by-step guide on how to get your tax ID with your NIN (National Identification Number). I will also highlight how businesses, organisations, government ministries/agencies, and non-residents can obtain their Tax IDs.

What is Tax ID?

Tax ID is a unique 13-digit number that identifies a taxpayer in Nigeria. It is used to identify individuals, businesses, organisations, government ministries/agencies, and non-residents for tax administration, compliance, and enforcement.

It will run simultaneously with existing tax identification systems, like the TIN (Tax Identification Number), but would likely phase them out in the future.

The Tax ID is designed to be unique for each individual and entity, reducing duplication, fraud, and identity mismatches.

It also enables smoother interactions across banks, employers, regulators, and government agencies, while supporting more efficient tax assessment, filing, and ongoing compliance monitoring.

How to Get your Tax ID with your NIN

Your Tax ID is linked to your NIN. The Joint Revenue Board and the Nigeria Revenue Service have created a portal to enable individuals, businesses, government agencies, and non-residents to retrieve their Tax ID. Here is the step-by-step guide for obtaining your Tax ID with your NIN as an individual.

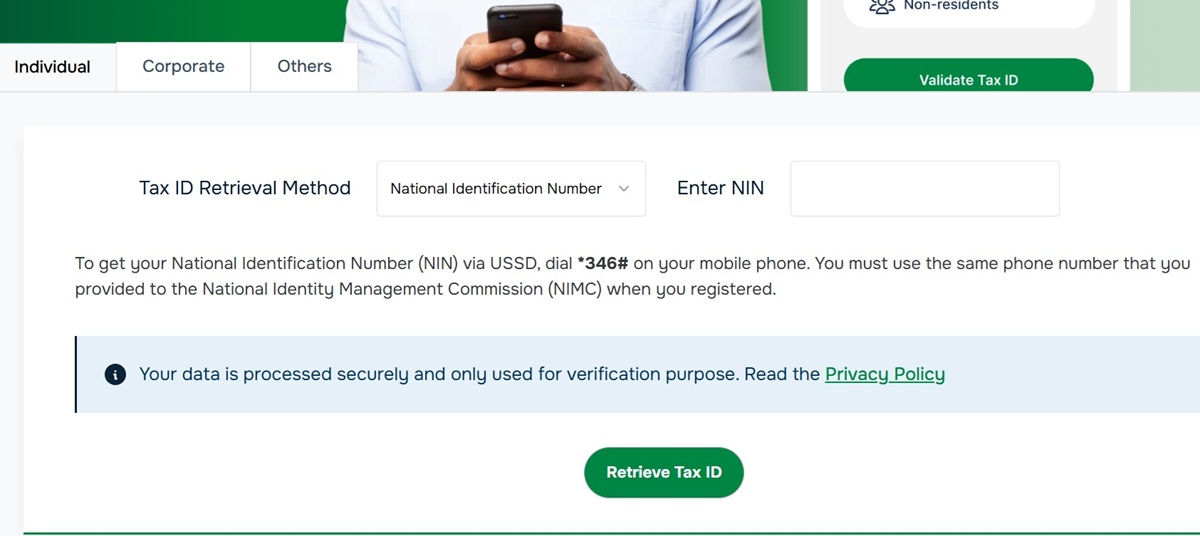

1. Visit taxid.firs.gov.ng or taxid.jtb.gov.ng: Using your mobile phone or computer, visit the NRS or JRB tax ID portals at taxid.firs.gov.ng or taxid.jtb.gov.ng, respectively. This will open a page requiring you to enter your NIN.

2. Enter your NIN: You can just type in your NIN in the field provided. If you cannot remember your NIN, you can dial *346# to retrieve it at a cost of 20 Naira. There is also an option to use the NINAuth share code, a one-time secure code generated from the NIMC NINAuth App. If you prefer to use the NINAuth share code, change the Tax Retrieval Method from National Identification Number to NINAuth share code and enter the code generated from the NIMC NINAuth App.

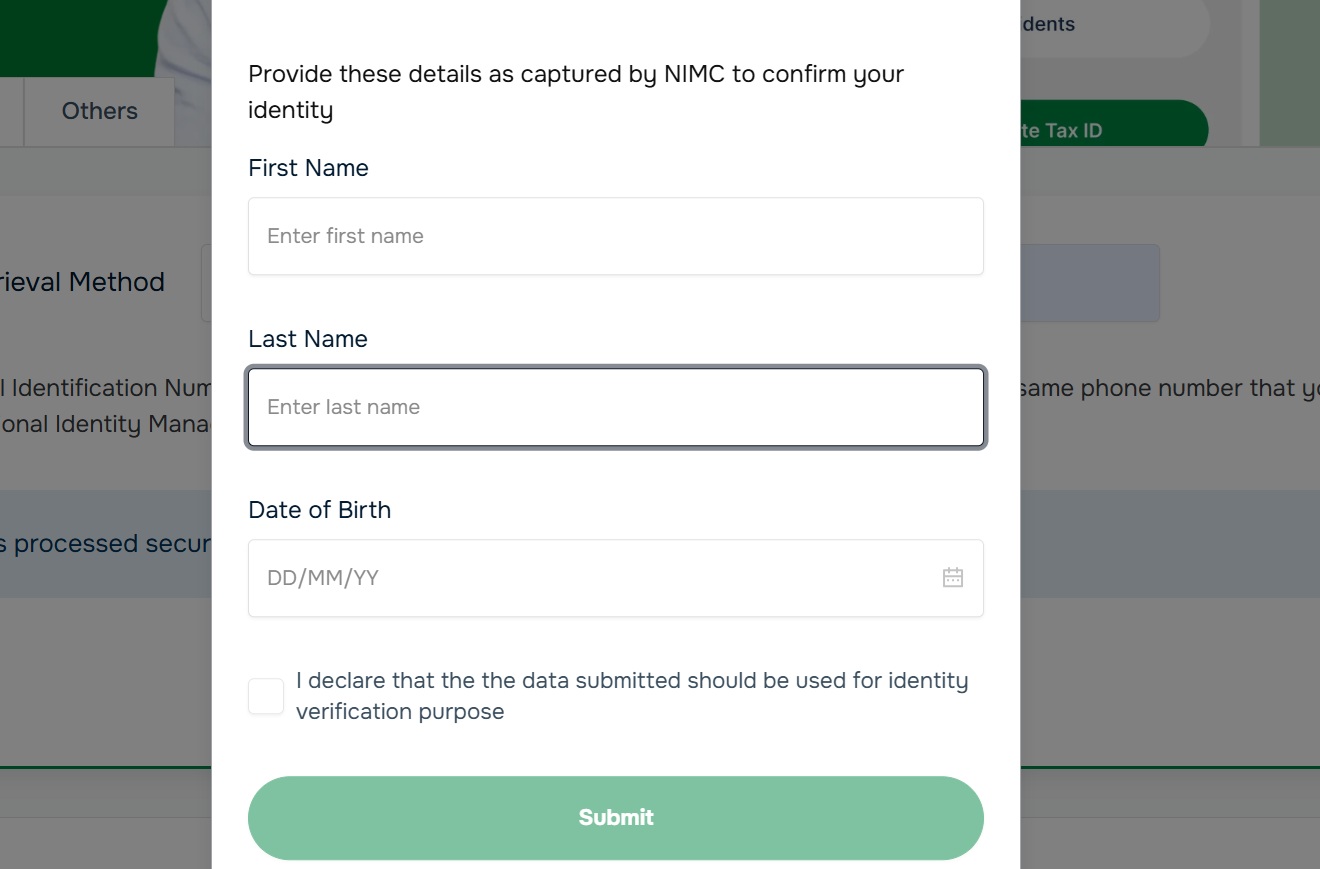

3. Click the Retrieve Tax ID Button: Click or tap the Retrieve Tax ID button. A form will open requesting your name and date of birth.

4. Enter your First Name and Last Name: Type in your first name and last name in the appropriate fields on the form. Please make sure your entry matches your NIN entry.

5. Enter your Date of Birth: Select your date of birth. Also, make sure that the date you enter matches what is in the NIN database.

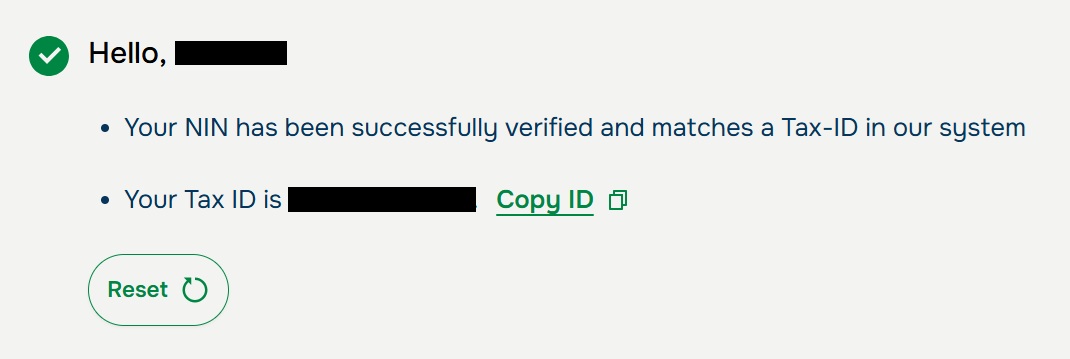

6. Click the Submit Button: Click or tap the Submit button. If the process is successful, your Tax ID will be displayed with the message format below:

Hello, [Your First Name]

Your NIN has been successfully verified and matches a Tax-ID in our system.

Your Tax ID is [Your 13-digit Tax ID]

7. Copy or Screengrab your Tax ID: Click the Copy ID link to copy your Tax ID, then paste and save it in a secure location on your mobile phone or computer. You can also just write it down in your diary or jotter for future reference. In the future, the NRS and JRB may provide a USSD code that will enable you to retrieve your Tax ID on your phone just like NIN and BVN.

Also see the Best Accounting Software.

How to Obtain a Tax ID for Businesses and Organizations

While NIN is required to retrieve the Tax ID for an individual, the company or organization number issued by CAC (Corporate Affairs Commission) is required to retrieve the Tax ID for businesses and organizations registered as Business Name, Company, Incorporated Trustee, Limited Partnership, and Limited Liability Partnerships.

The portal is set to default to Individual. To retrieve the Tax ID for a Company, Business Name, Incorporated Trustee, Limited Partnership, or Limited Liability Partnerships, you have to select Corporate and select the type of business or organization incorporation, and then enter the CAC ID number for the business or organization and click the Retrieve Tax ID button.

You may also be interested in MTN MoMo Bill Payment, and 9Mobile rebrands to T2 Mobile.